Our Services

-

Bookkeeping

Bookkeeping is the day-to-day recording and organising of your business income and expenses, so your accounts are accurate and up to date. We keep your records tidy, reconcile your bank transactions, track invoices and receipts, and make sure everything is ready for VAT returns, MTD submissions, and year-end accounts.

-

VAT RETURNS

VAT returns are the regular reports you submit to HMRC showing the VAT you’ve charged on sales and the VAT you can reclaim on purchases. We check your records, calculate and file your return accurately and on time (MTD-compliant), and make sure you’re claiming what you’re entitled to while staying fully compliant.

-

Payroll

Payroll is the process of paying your staff correctly and reporting the right information to HMRC through Real Time Information (RTI). We run your payroll each pay period, calculate pay, tax, NI and pensions, produce payslips, and handle submissions and year-end forms so everything stays compliant and stress-free.

-

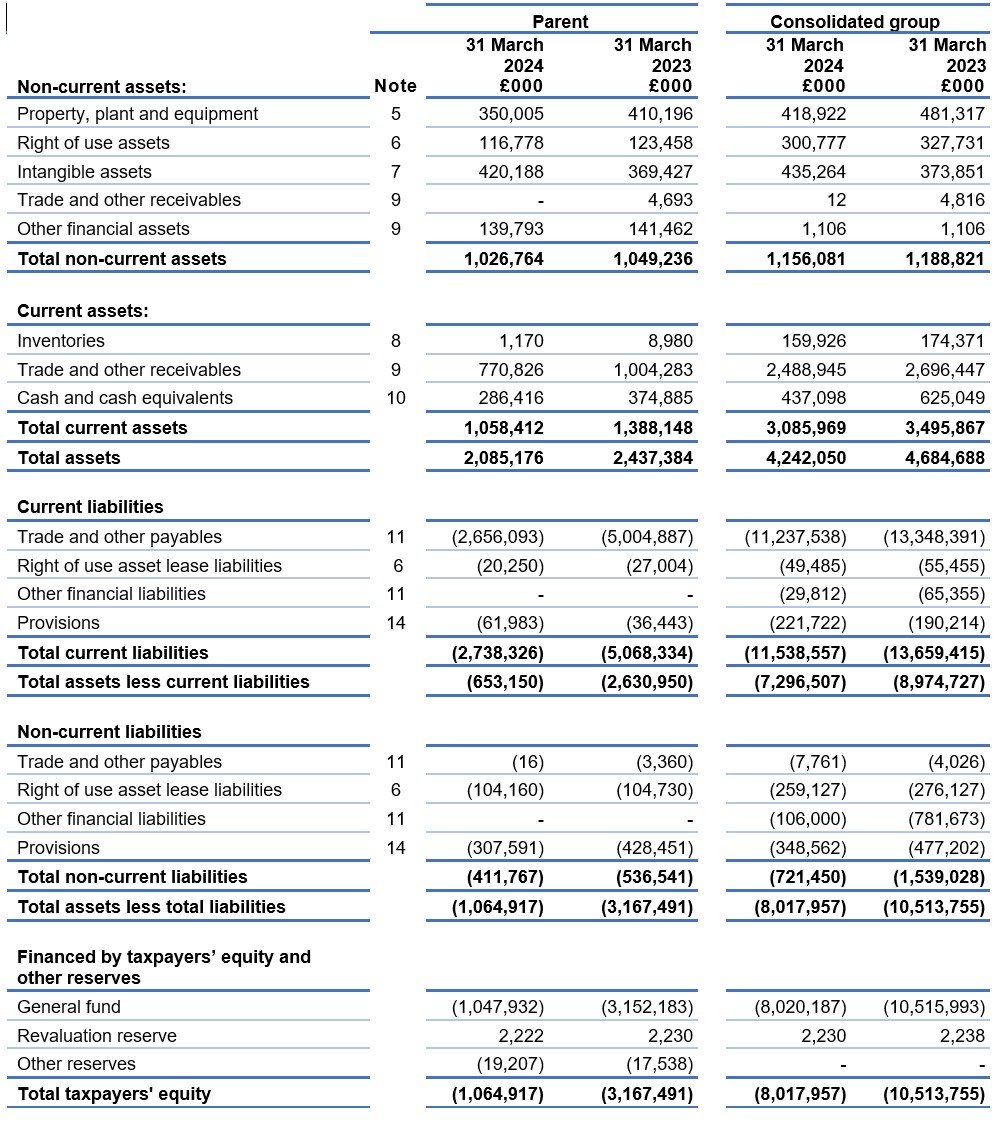

Financial statements and final accounts

Financial statements and final accounts are your year-end reports that show how your business performed and where it stands, and they’re the figures used for tax and statutory filing. We prepare accurate accounts, tidy up year-end adjustments, and produce clear reports you can understand—then file everything correctly and on time.

-

MTD FOR SOLE TRADERS

Making Tax Digital (MTD) for sole traders means keeping digital records and sending regular updates to HMRC using approved paid for software. We’ll set you up with a simple system, keep your records organised, and handle your submissions so you stay compliant with minimal hassle.

-

SELF ASSESSMENT

Self Assessment is the annual tax return that reports your income and calculates the tax you owe to HMRC. We prepare and file your return accurately, make sure all allowable expenses and reliefs are claimed, and keep you informed of what’s due and when, with no last-minute stress.